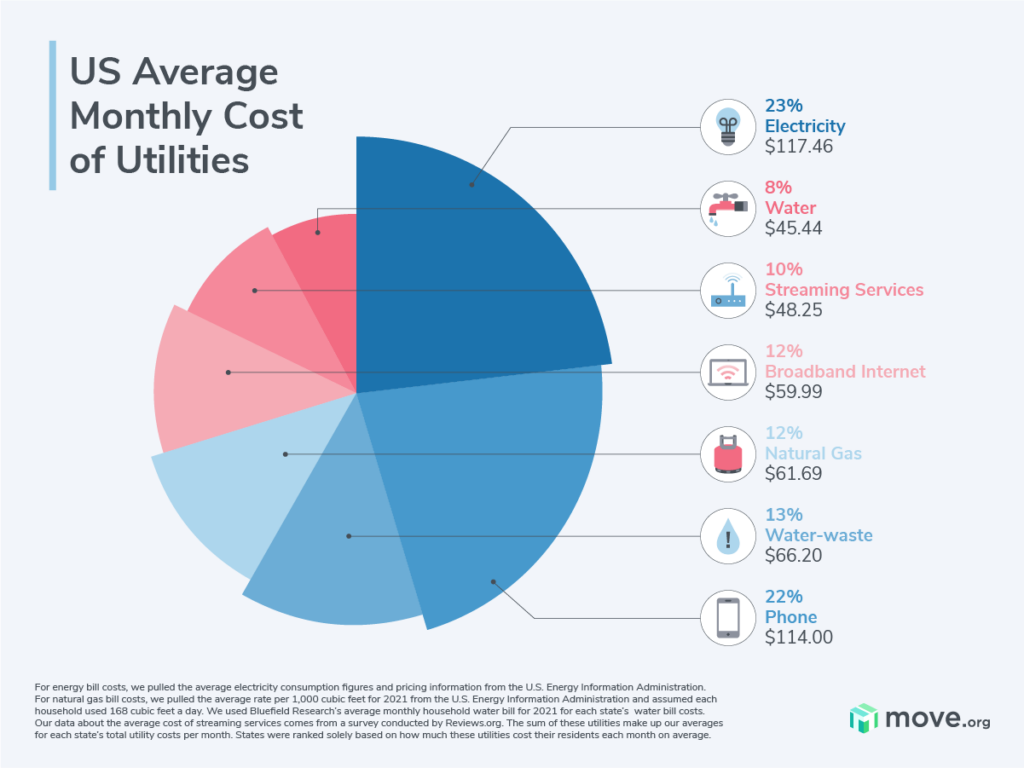

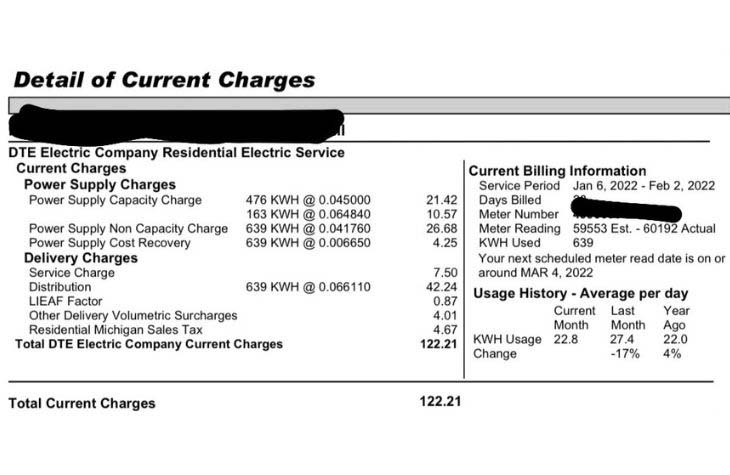

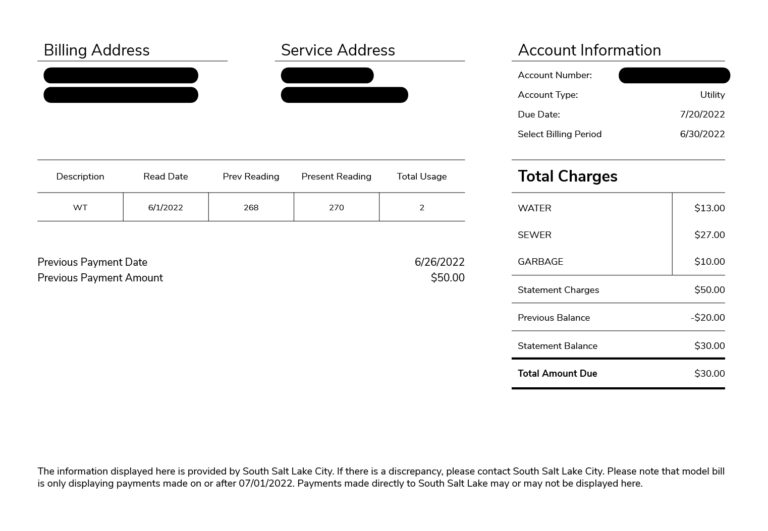

If you just moved or are planning a move, it’s important to plan your monthly budget around utility bills. In the US, residents should plan to spend at least $290.79 per month on essential utilities like electricity, natural gas, water, and sewer. Depending on where you live and your container size, you should also budget $25–$100 for trash and garbage collection. Additional utilities include internet ($59.99), phone ($114), and streaming services ($48.25).

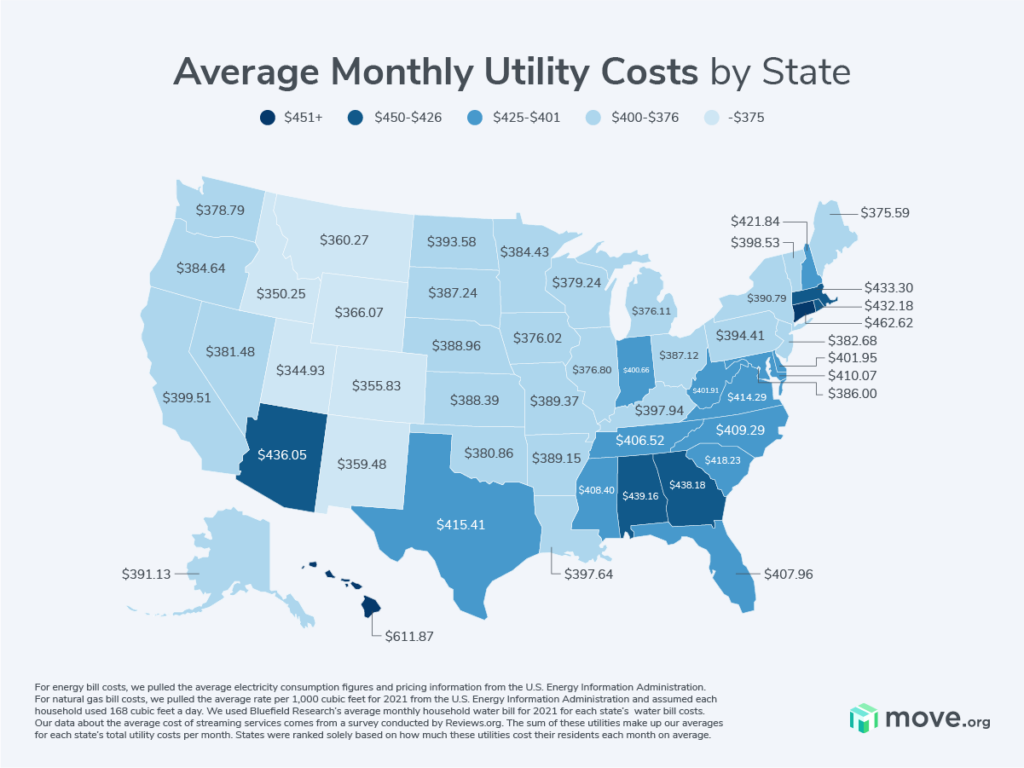

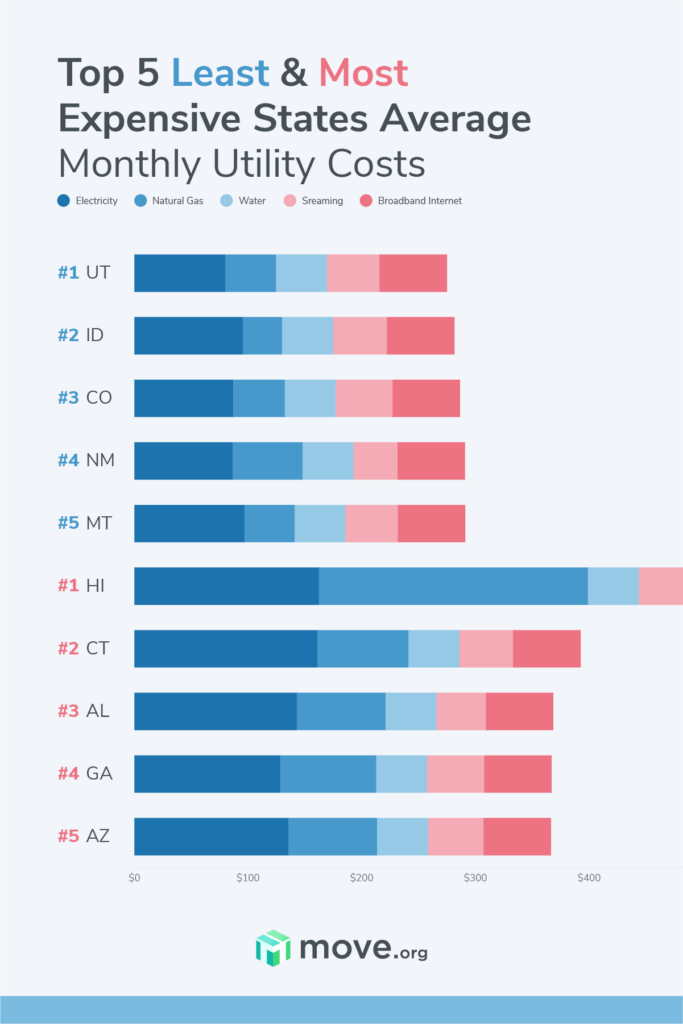

Of course, climate and energy costs vary from one state to another, so utility bills do too. We looked into the average utility costs in individual states to see just how much they vary. Keep reading to learn more about monthly utility costs and get money-saving tips.